MacTalk

September 2023

Apple Q3 2023 Earnings Down 1% on Exchange Rates

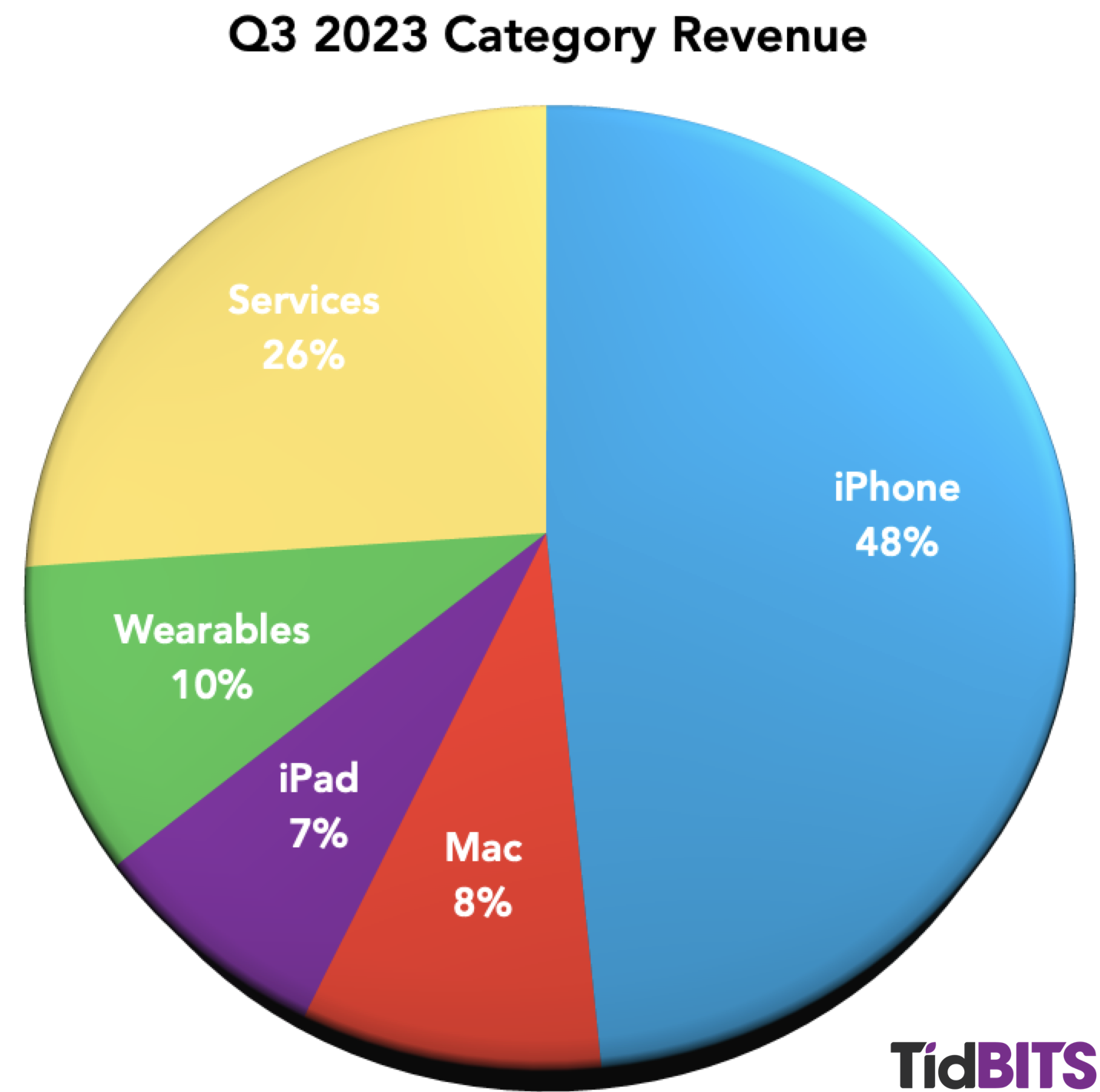

Reporting on its financial results for the third fiscal quarter that ended 30 June 2023, Apple has announced profits of $19.9 billion ($1.26 per diluted share) on revenues of $81.8 billion. Although the company’s revenues were down by 1% compared to the year-ago quarter, largely due to foreign exchange rates that reduced revenues by nearly 4%, profits were up slightly from the 2022 quarter (see “Apple Outperforms in Q3 2022 Despite a Rocky Road,” 28 July 2022).

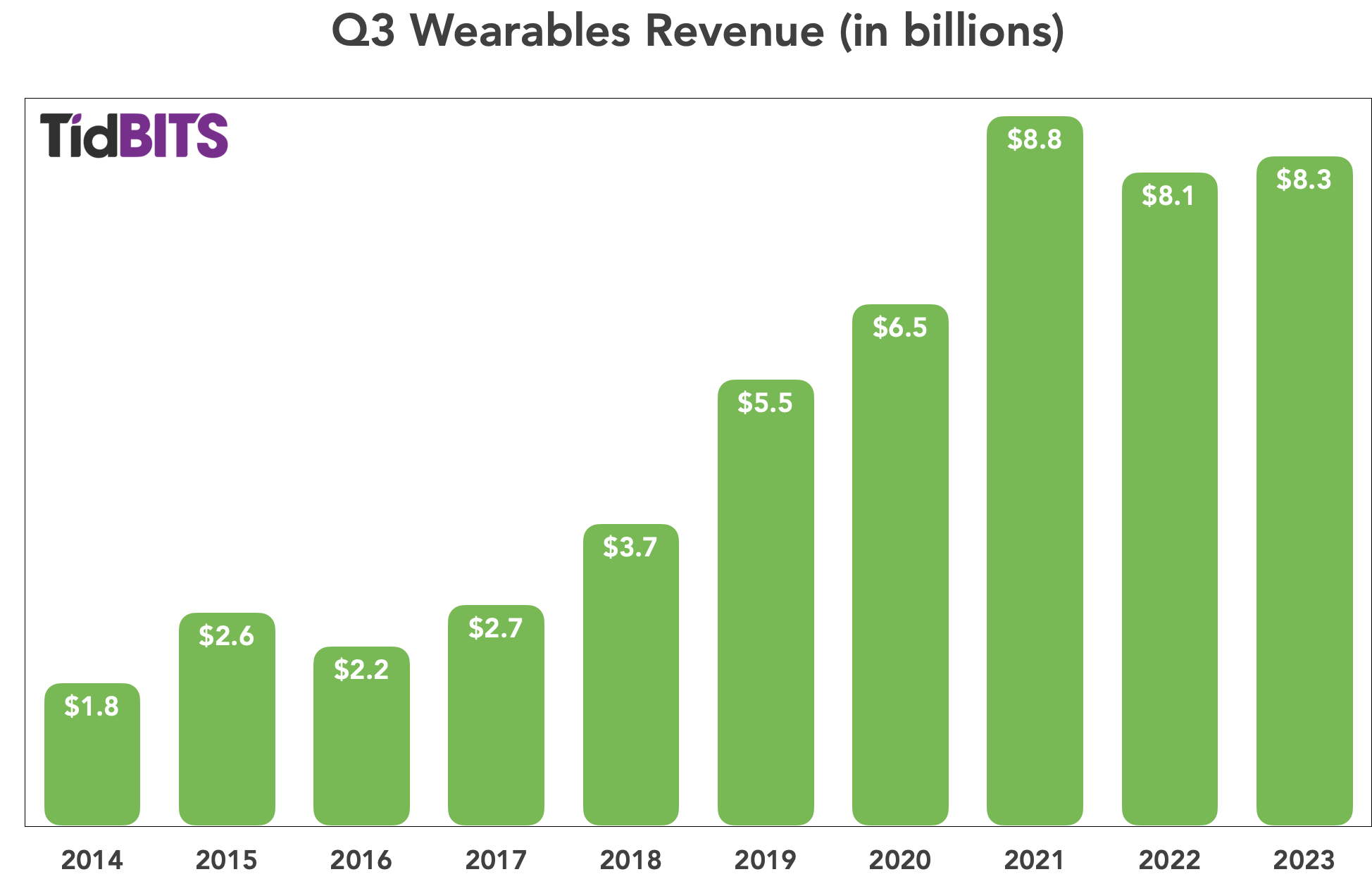

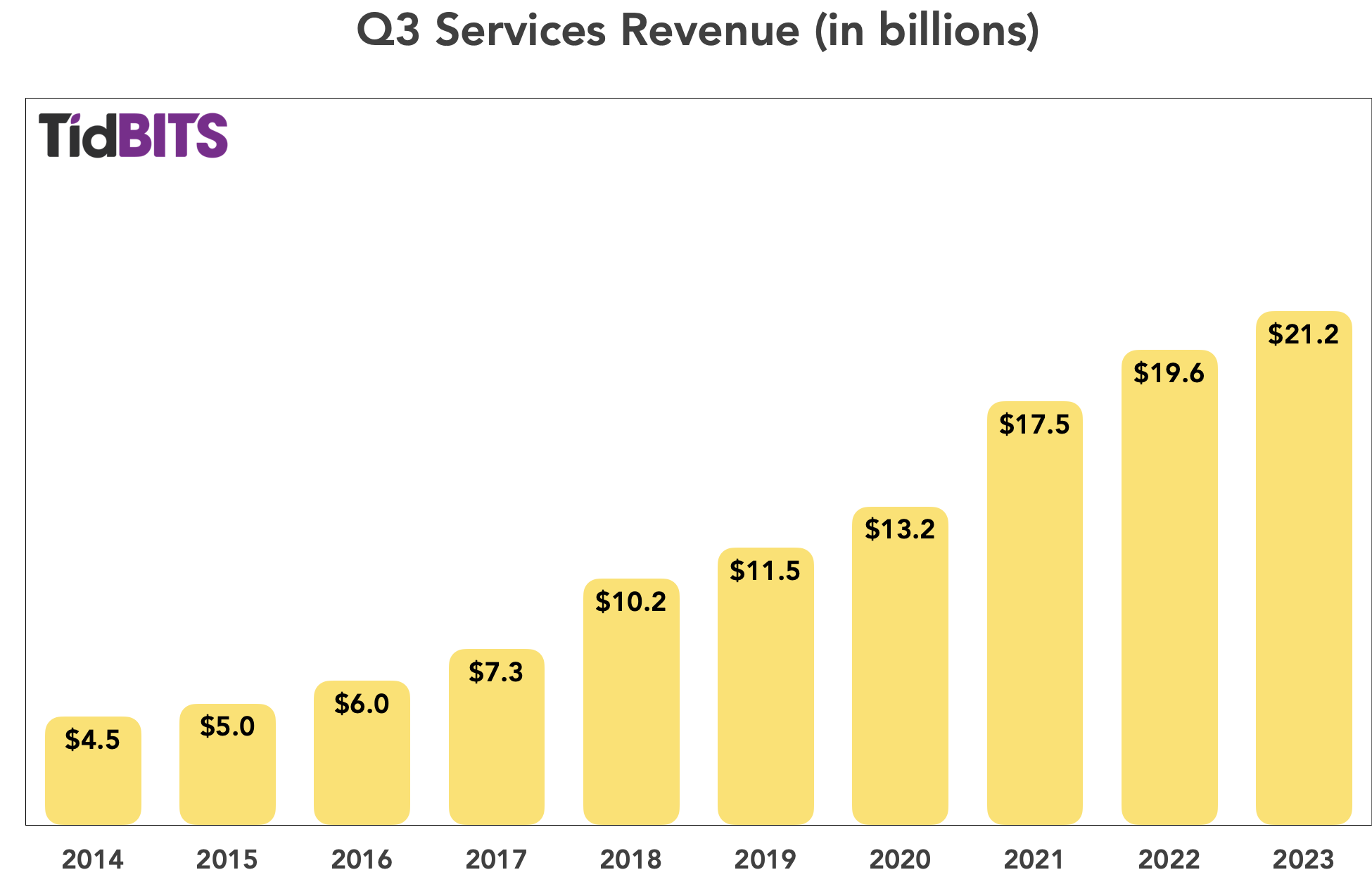

Despite sales drop-offs in its iPhone, Mac, and iPad categories, Apple saw a small increase of 2.5% in the Wearables, Home, and Accessories category and a more significant increase of 8.2% in Services. In fact, Services brought in more than a quarter of Apple’s income during the quarter for what we believe is the first time. Apple made much of the percentage of first-time buyers in some categories and emphasized stratospheric customer satisfaction rates of 96–98%, although a recent report calls those numbers implausible.

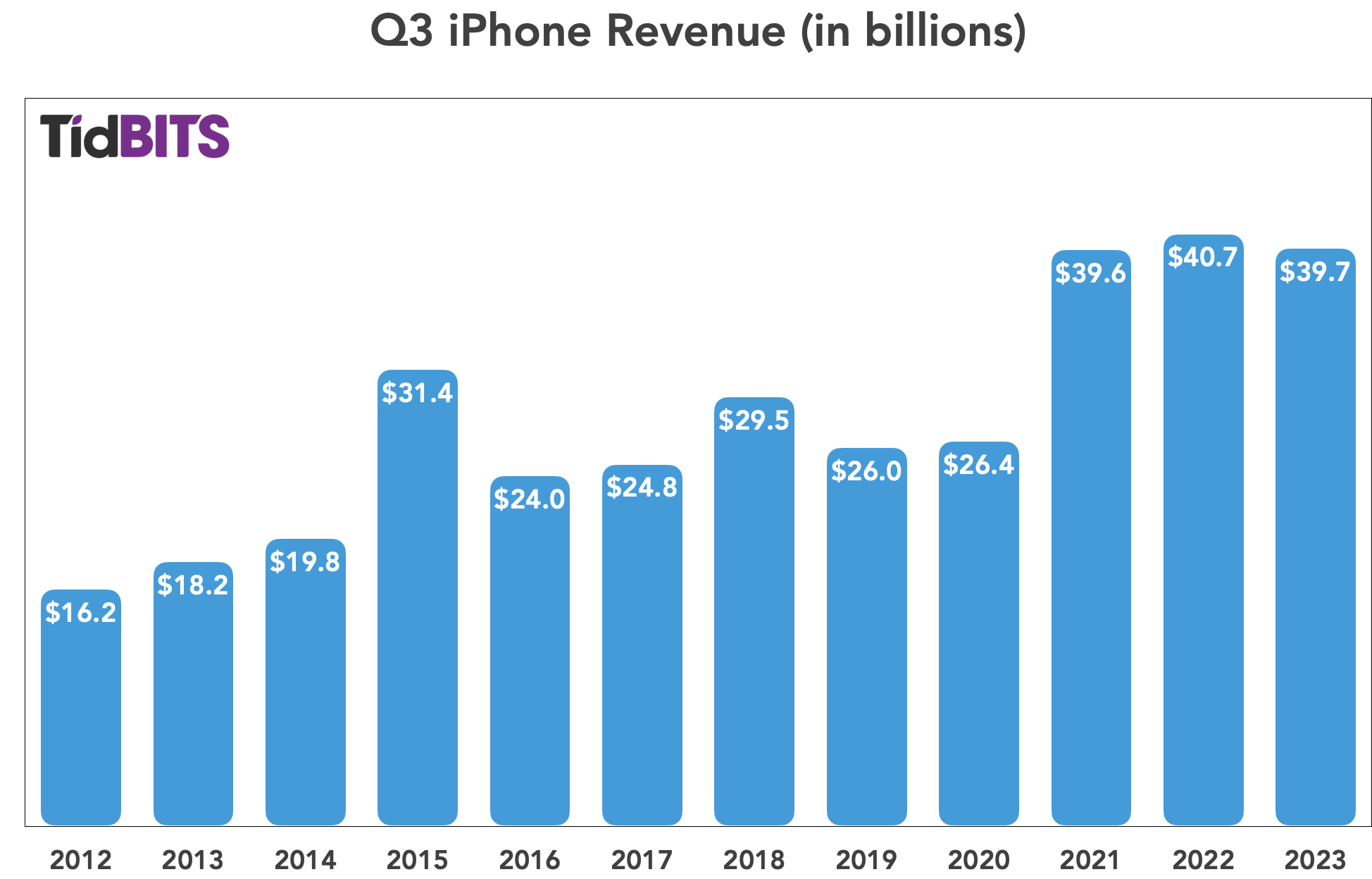

iPhone

Overall, iPhone sales were down 2% compared to sales in the same quarter last year, although Apple CFO Luca Maestri did make clear that “down” was a relative term, given that iPhone sales income was up on a “constant currency basis.” Nonetheless, CEO Tim Cook admitted that increasing iPhone sales, particularly in the Americas, was “challenging.” More positive were the third-quarter record sales for the iPhone in emerging markets, including China, India, Latin America, and the Middle East.

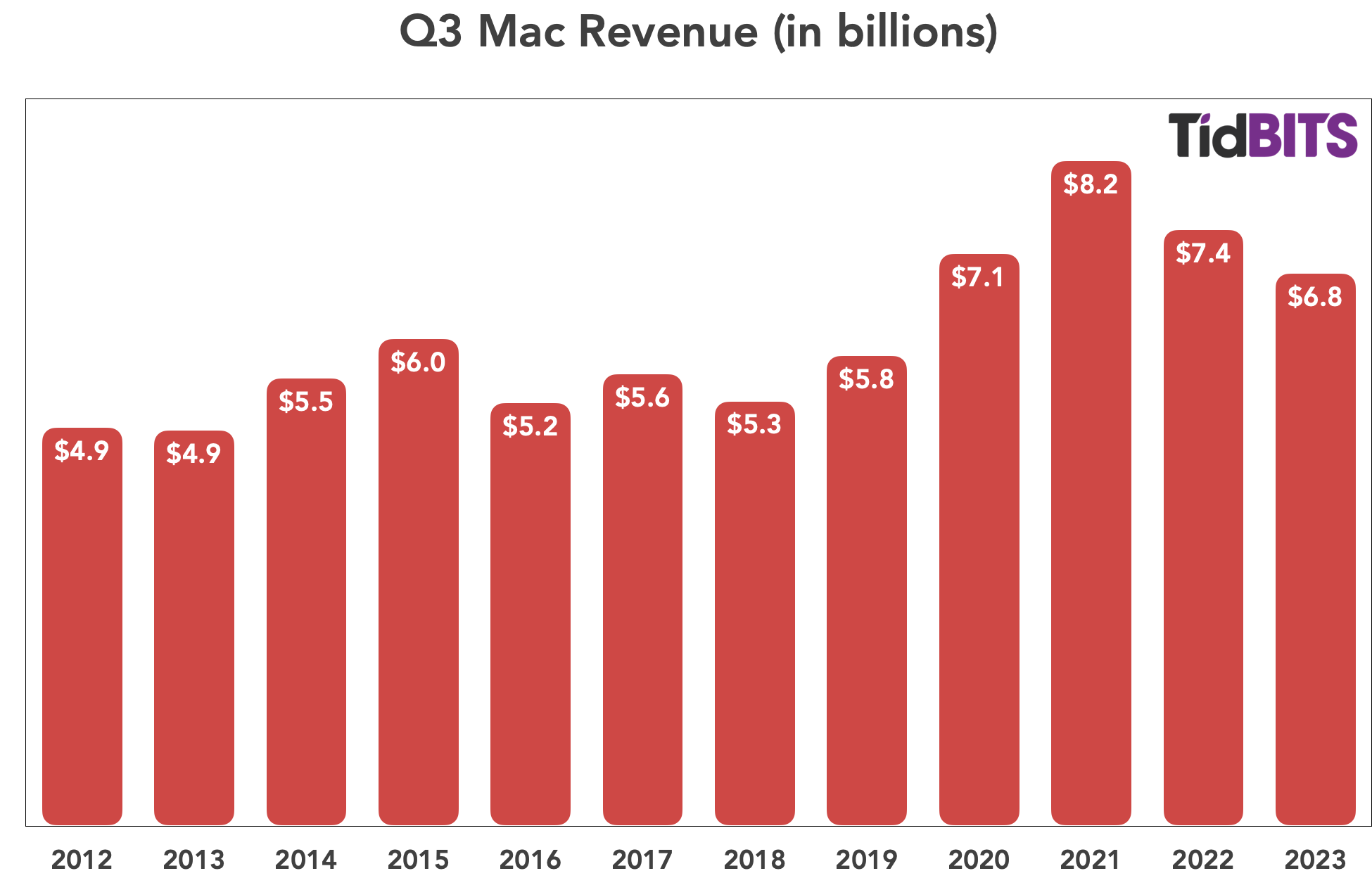

Mac

Even though Apple was pleased to note that its Mac transition to Apple silicon is now complete (see “Three New Macs Complete the Apple Silicon Transition,” 5 June 2023), those releases didn’t prevent Mac sales from falling 7% compared to the year-ago quarter. Nor does Apple expect the Mac sales picture to brighten significantly next quarter, with the macro-economic environment being what it is. Moreover, comparing next quarter’s Mac sales to the same quarter a year ago will be difficult because the Q4 2022 figures were juiced by Apple fulfilling pent-up demand as it recovered from last year’s factory shutdowns. On the plus side, Apple said almost half of Mac buyers were new to the platform.

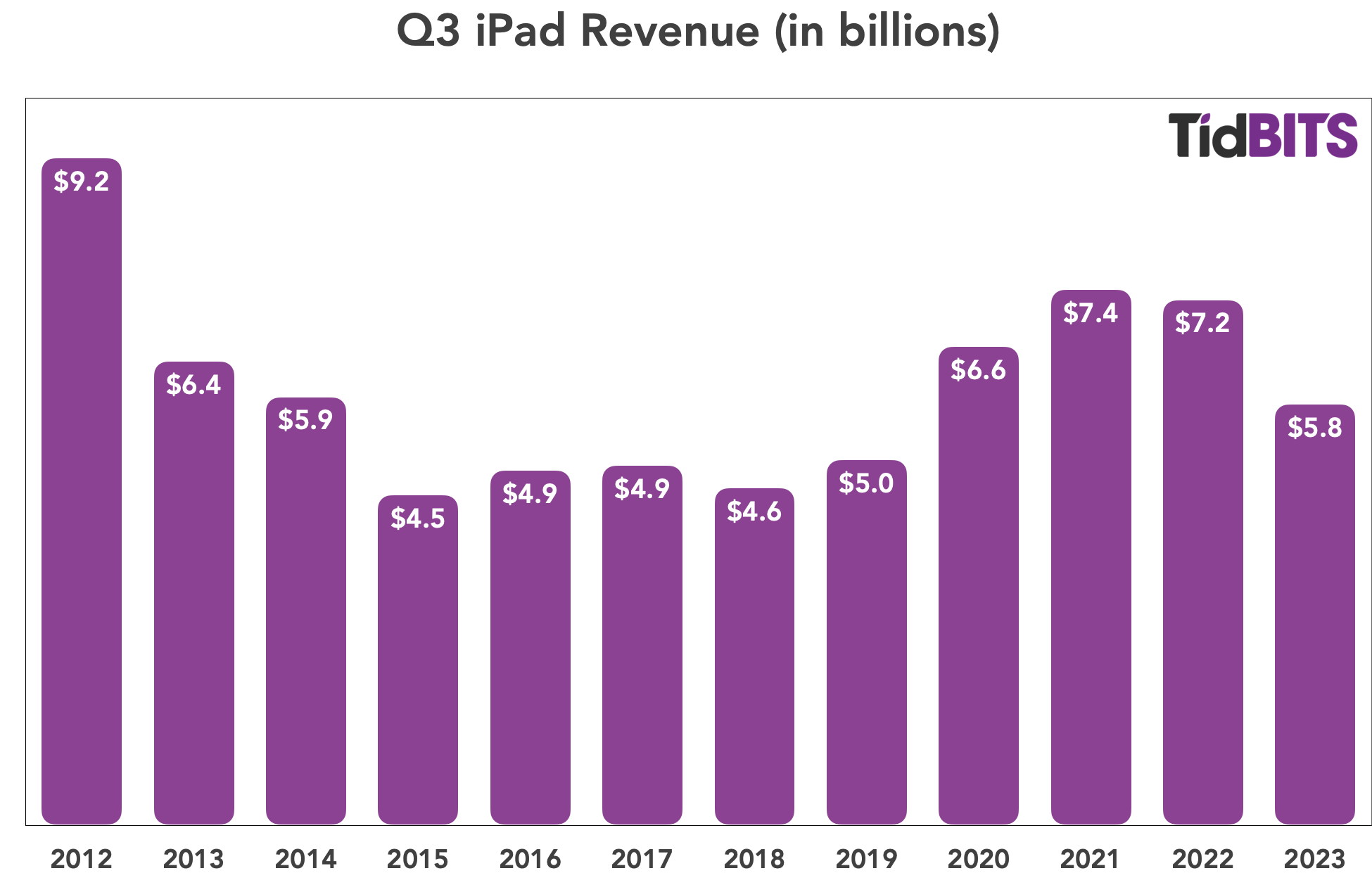

iPad

iPad sales revenue was down 20%, partly because of a lack of new models, whereas the year-ago quarter saw the release of an updated iPad Air. Nor does Apple expect iPad sales to rebound next quarter. As with the Mac, comparing next quarter’s results with those from the previous year won’t be easy, as Q4 iPad sales were boosted last year when Apple finally accumulated enough inventory to fulfill pent-up demand. Nonetheless, the iPad continues to attract new users, with over half of the quarter’s iPad buyers being first-time purchasers.

Wearables

The Wearables product segment posted a sales increase of over 2% compared to the year-ago quarter, largely thanks to the Apple Watch. Apple continued to emphasize new customers, saying that two-thirds of Apple Watch purchasers in the quarter were new to the product.

Services

The star of Apple’s quarterly revenue picture was its Services segment, with a “better than expected” increase of 8.2%. The category not only bested the $20 billion revenue mark for the first time but also exceeded 1 billion subscribers. With gross margins for its Services offerings (70.5%) double those that Apple achieves with its hardware products (35.4%), revenue increases in this sales category are particularly rewarding for the bottom line. So if it seems like Apple is continually trying to encourage service subscriptions, you can see why.

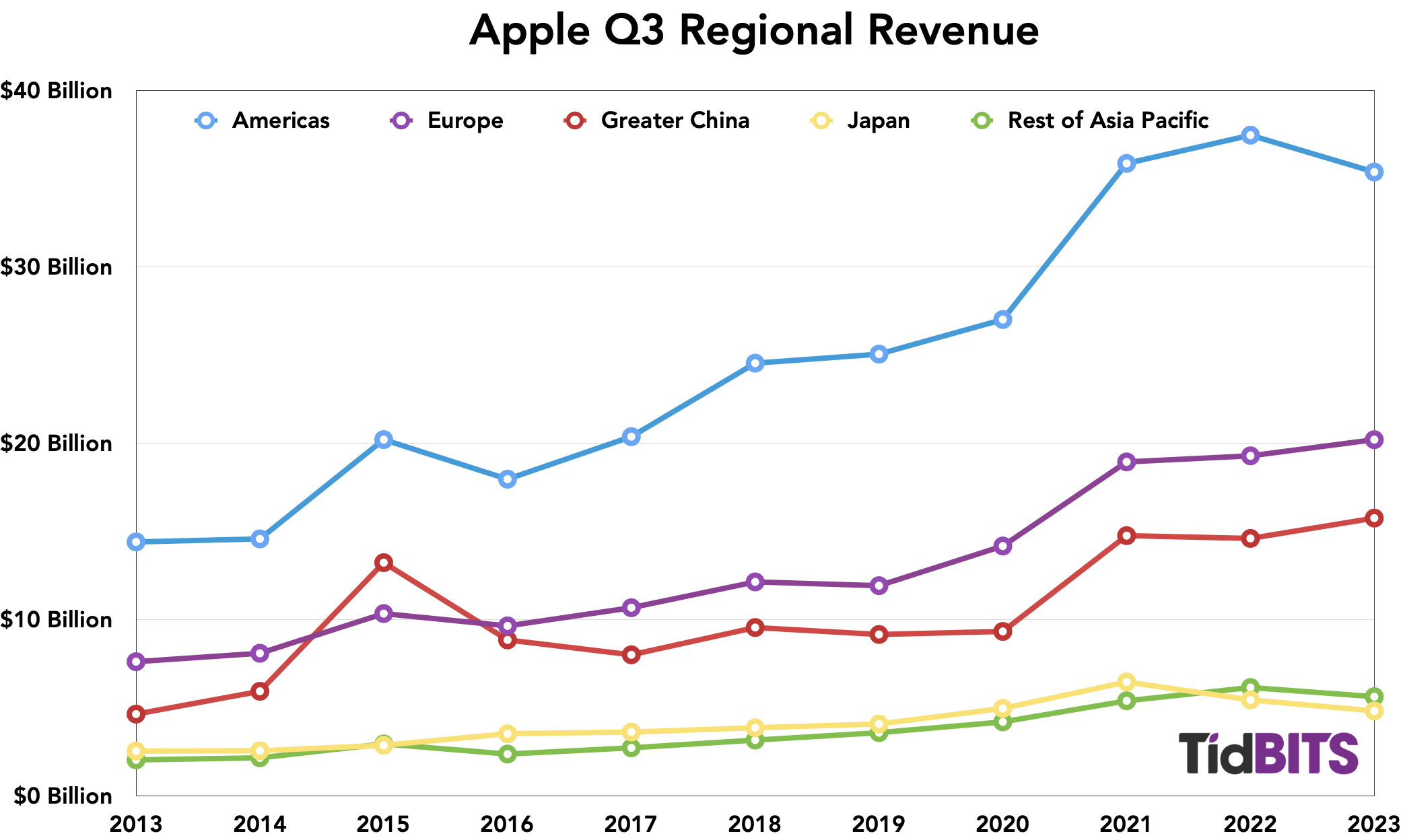

Regions

Apple’s international income picture was a mixed bag. Revenues were off in the Americas (-5.6%), in Asia Pacific (-8.5%), and in Japan (-11.5%), but Apple posted revenue increases in Europe (4.8%) and in Greater China (7.9%). Cook was especially pleased by Apple’s growth in emerging markets, such as India, and expects increases in those markets to continue.

The Future

Apple seems to be keeping new products in the pipeline, controlling operating expenses (and even reducing them from the previous quarter), and generally executing well. However, between a product release schedule that doesn’t always map neatly to fiscal quarters and pandemic-driven effects, it’s easy to see why Tim Cook and Luca Maestri kept talking about “difficult compares.” And it must be frustrating for Apple to increase revenues only to have exchange rates eliminate those gains, although some past quarters probably benefited from exchange rates going in the other direction.

The Vision Pro garnered a few mentions, though no one seems to think it will affect Apple’s revenues in a big way soon. When analyst Sidney Ho asked Tim Cook about that, Cook said he used the Vision Pro daily but declined to forecast revenues for it.

Although Cook mentioned the fact that Apple TV+ has earned more than 1500 Emmy nominations and 370 wins so far, he sidestepped the effect the ongoing strikes by the Writers Guild of America and the actors’ union SAG-AFTRA might have on Apple getting new Apple TV+ content to help feed the Services engine. No analysts probed for further information, not that they would likely have gotten an answer.

Regardless of these questions, Cook closed his remarks by emphasizing Apple’s commitments to accessibility, privacy, the environment, and education before saying:

Looking ahead, we’ll continue to manage for the long term, always pushing the limits of what’s possible and always putting the customer at the center of everything we do.

One can quibble with particular decisions or directions, but Apple clearly has rational, caring adults in charge, something that’s no longer a given among tech companies.

Contents

Website design by Blue Heron Web Designs