MacTalk

November 2022

Apple Weathers Stormy Seas in Q4 2022

Reporting on its financial results for its fourth fiscal quarter of 2022, Apple announced profits of $20.7 billion ($1.29 per diluted share) on revenues of $90.1 billion. The company’s revenues were up 8% compared to the year-ago quarter, with net results up by 4% (see “Apple Q4 2021 Results Smash Revenue Records but Could Have Been Even Better,” 28 October 2021).

This quarter’s numbers are fascinating. This time, the Mac led in terms of revenue growth, while Services remained flat, and the iPad suffered a double-digit year-over-year decline. Apple CEO Tim Cook explained that much of the iPad decline is due to continuing supply constraints in some areas and not a drop in demand, so in the long run, these numbers may be statistical noise, though it will be at least another year before we know for sure.

Much as it did during the height of the pandemic, Apple is again refusing to offer future guidance due to the uncertain economy. CFO Luca Maestri noted that strong foreign exchange “headwinds” adversely affected revenues in all of the company’s sales categories.

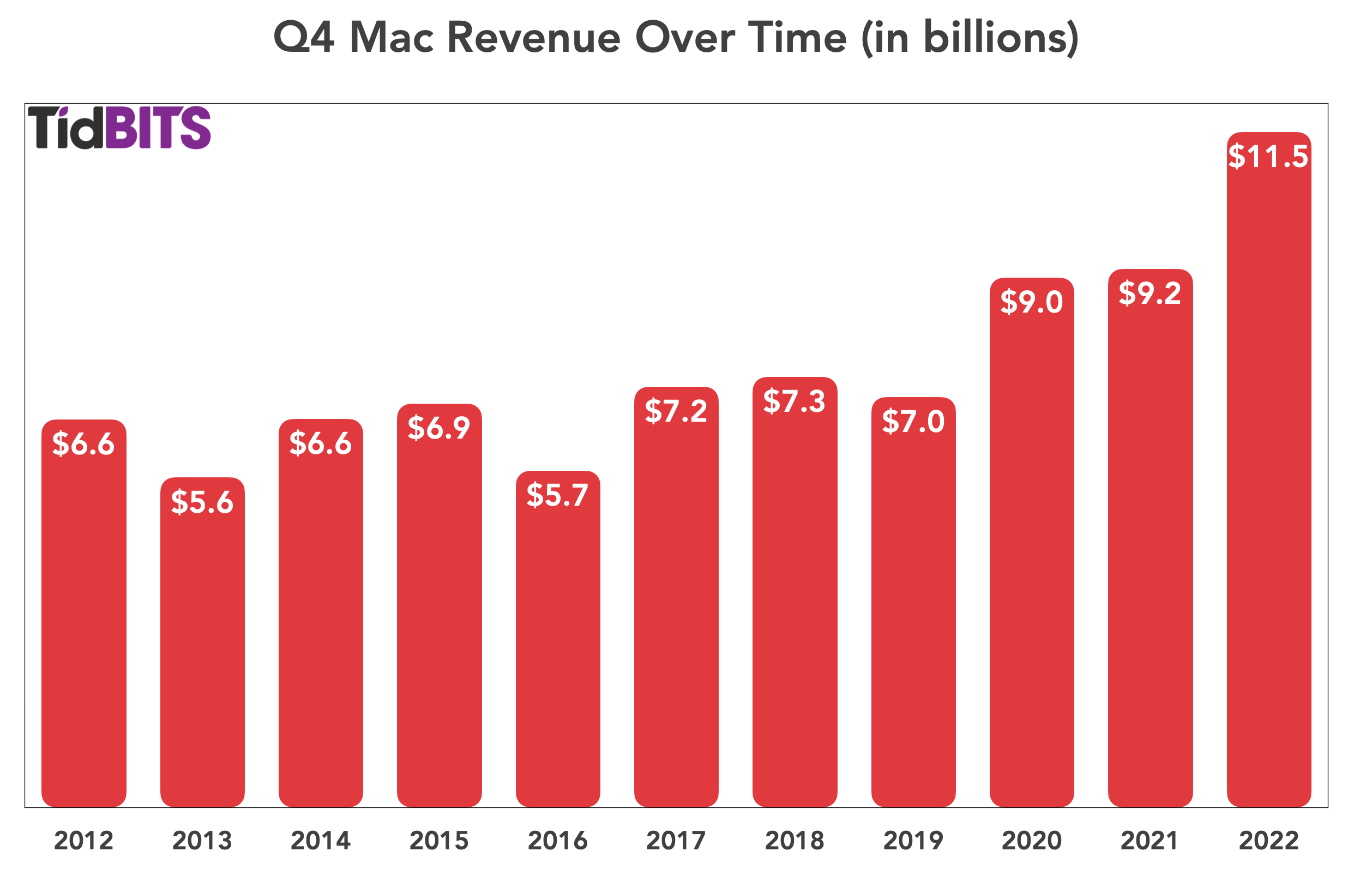

Mac

Let’s start with the Mac, which saw a phenomenal 25.4% year-over-year revenue increase, marking an all-time revenue record for Macs. Thanks to Apple silicon, the Mac has never been stronger, bringing in $11.5 billion in revenue in Q4. The release of a new M2-based MacBook Air during the quarter no doubt helped boost the sales numbers for the Mac. Maestri also attributed some of the strong demand for Macs to companies like Cisco offering Macs to their employees. In addition, Cook said that Apple was able to satisfy the backlog of Mac demand stemming from Q3 production woes, helping to enhance the Mac sales numbers this quarter.

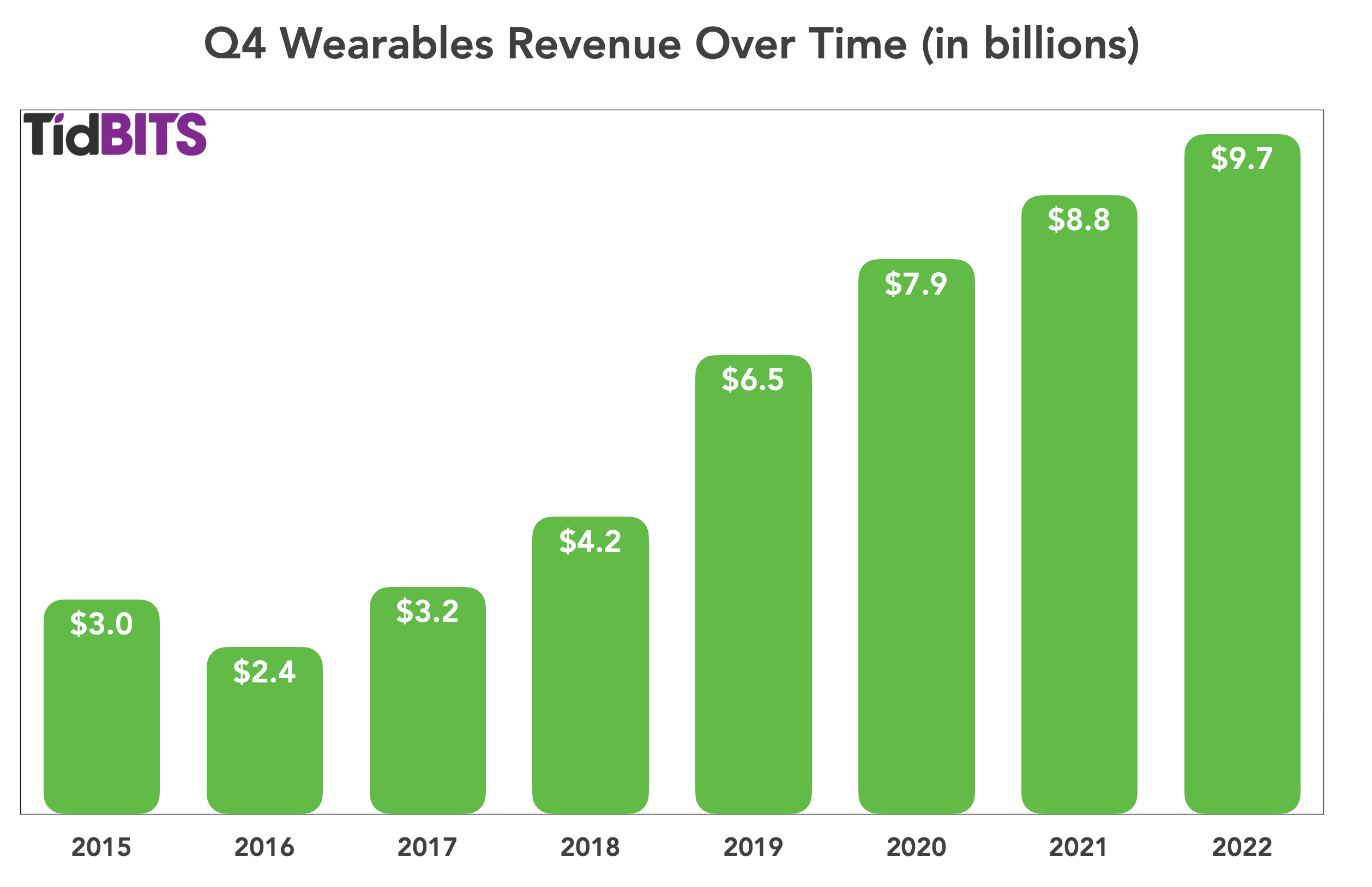

Wearables

In second place in Apple’s revenue growth race was the Wearables, Home, and Accessories category, which includes the Apple Watch, AirPods, Beats, and devices like the Apple TV and HomePod mini. That category saw 9.8% revenue growth over the past year, bringing in $9.7 billion. Maestri noted that two-thirds of Apple Watch purchasers during the quarter were new to the device. It was likely aided by the release of three new Apple Watch models in early September.

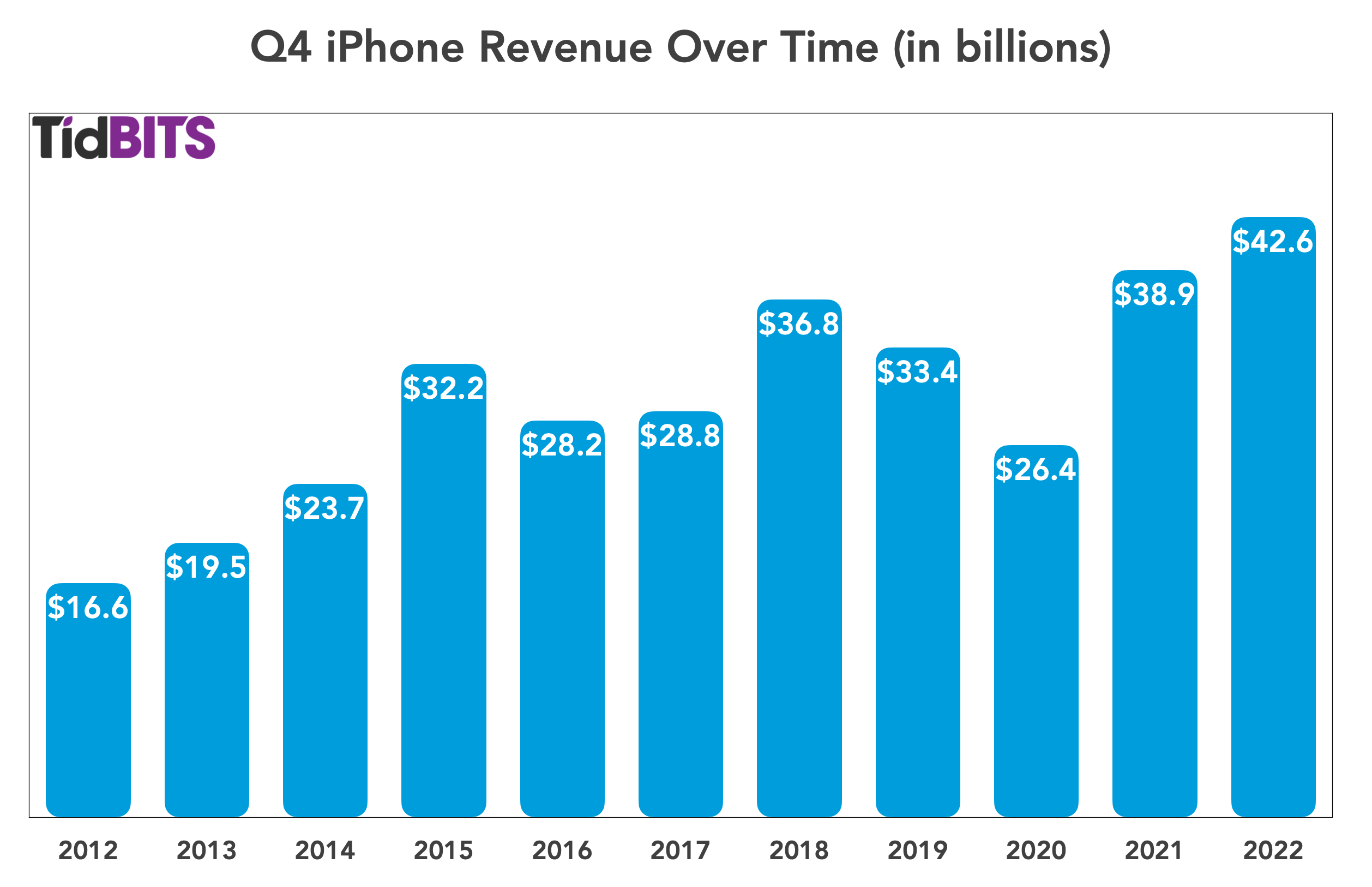

iPhone

The iPhone realized 9.7% growth over the past year, amounting to $42.6 billion in revenue. That level of growth was still sufficient for a September quarter revenue record. The emergence of new iPhone models near the end of the quarter may have helped bolster iPhone revenues, although there’s talk that the regular iPhone 14 models haven’t sold as well as Apple expected.

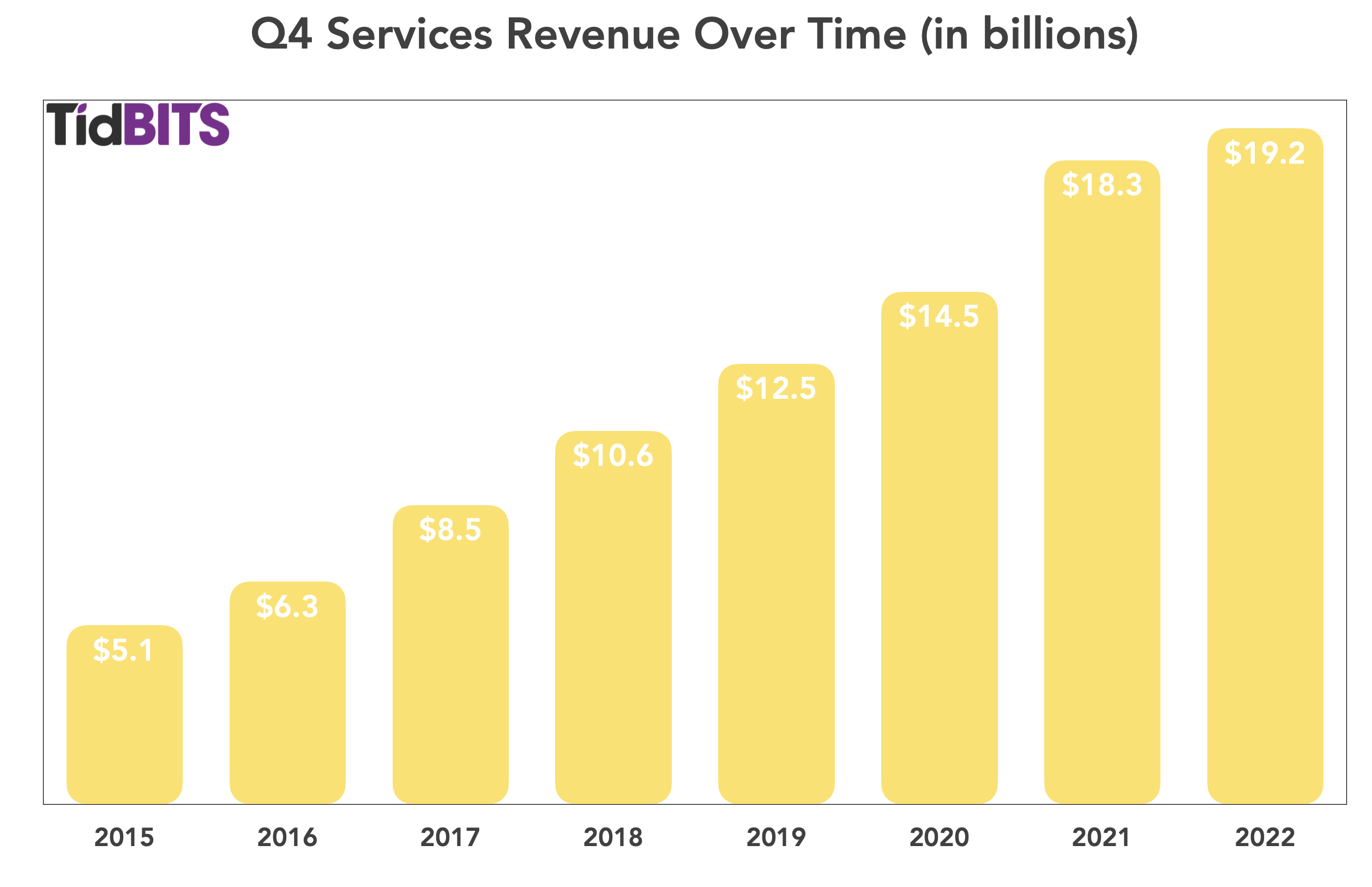

Services

For years, Services has fueled Apple’s continued growth, but that wasn’t the case this quarter: revenues increased by just 5% over the past year, bringing in $19.2 billion. As with other sales categories, Maestri blamed the strong dollar and weaker foreign currencies for the relatively small increase in Services revenue. However, Services revenue still broke its Q4 record, and Maestri mentioned that Apple has over 900 million paying subscribers now, implying a revenue stream that is both sizable and stable. When asked, Cook refused to link the decline in revenue growth to Apple’s recent service price hikes. Instead, he repeated the company’s previous explanation of increased music licensing costs and costs related to the growth of the Apple TV+ library (see “Apple Raises the Price of Apple Music, Apple TV+, and Apple One,” 24 October 2022).

iPad

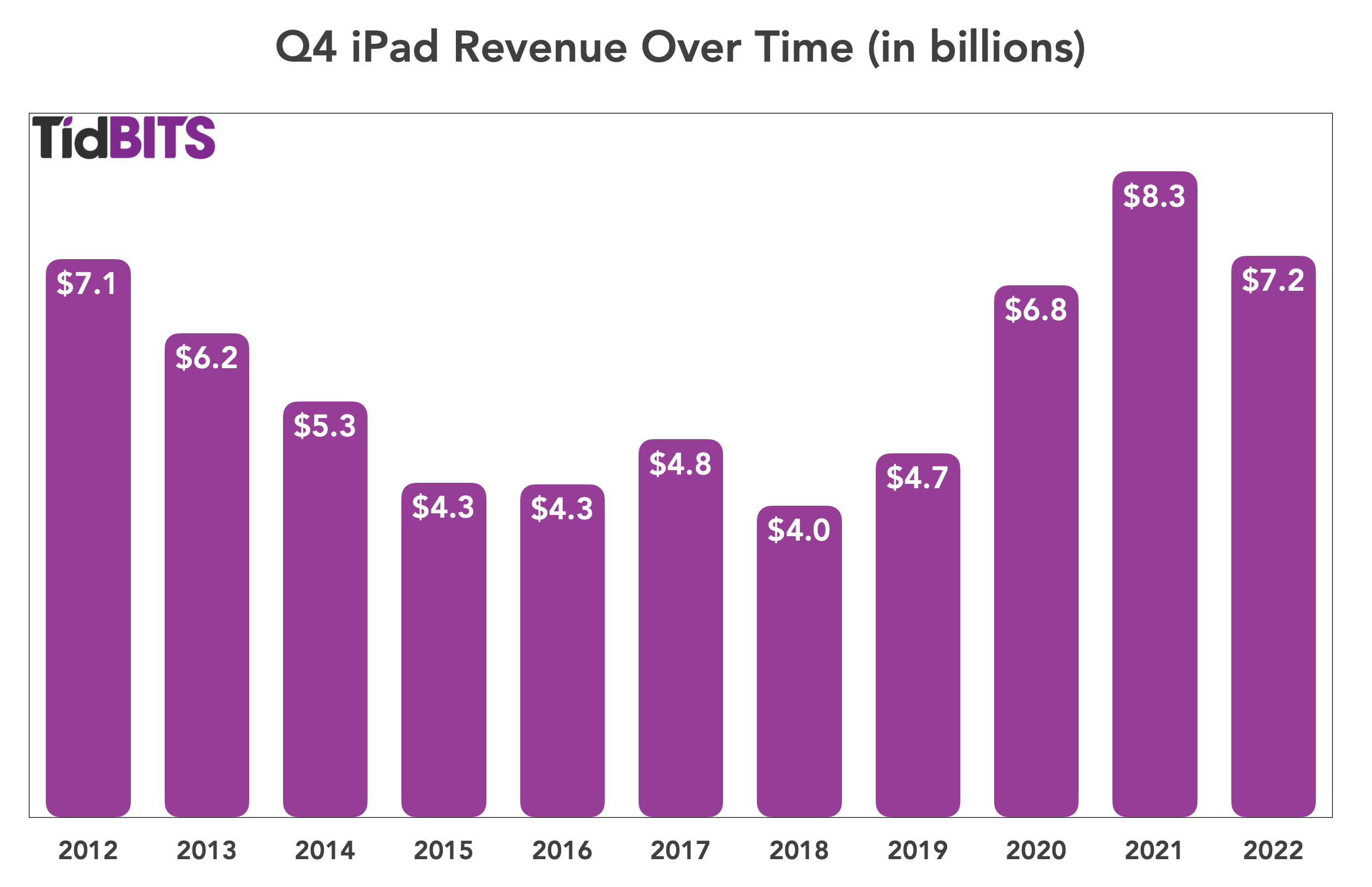

iPad revenues slumped once again after years of growth, with Q4 revenue declining by 13.1% year-over-year; nonetheless, Apple’s tablet offerings still hauled in $7.2 billion in revenue. The lack of new iPad model releases until after the September quarter undoubtedly helped depress the iPad sales numbers, with customers delaying purchases in anticipation of the imminent arrival of new iPads. In contrast, last year saw a new iPad Pro release just before the quarter started, fueling its revenue gains compared to this year.

Overall Mix and Geographic Regions

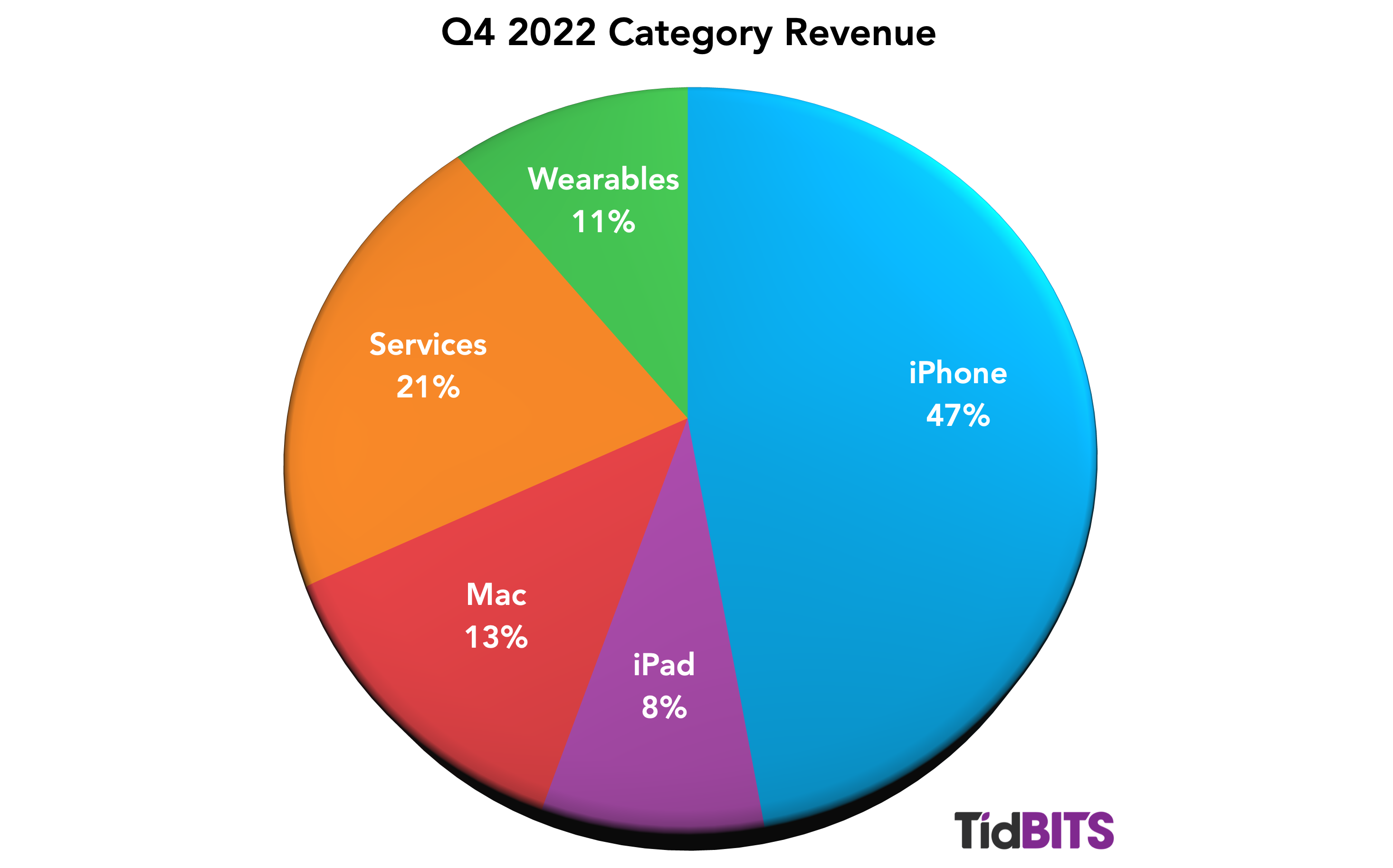

Much as it’s fun to look at the winners (and losers) in terms of growth percentages, it’s important to keep them in perspective when viewing Apple’s total revenue picture. Make no mistake, the iPhone is still the king of Apple’s income statement, accounting for just under half of Apple’s Q4 revenue (47%), while Services is in a strong second place with 21%.

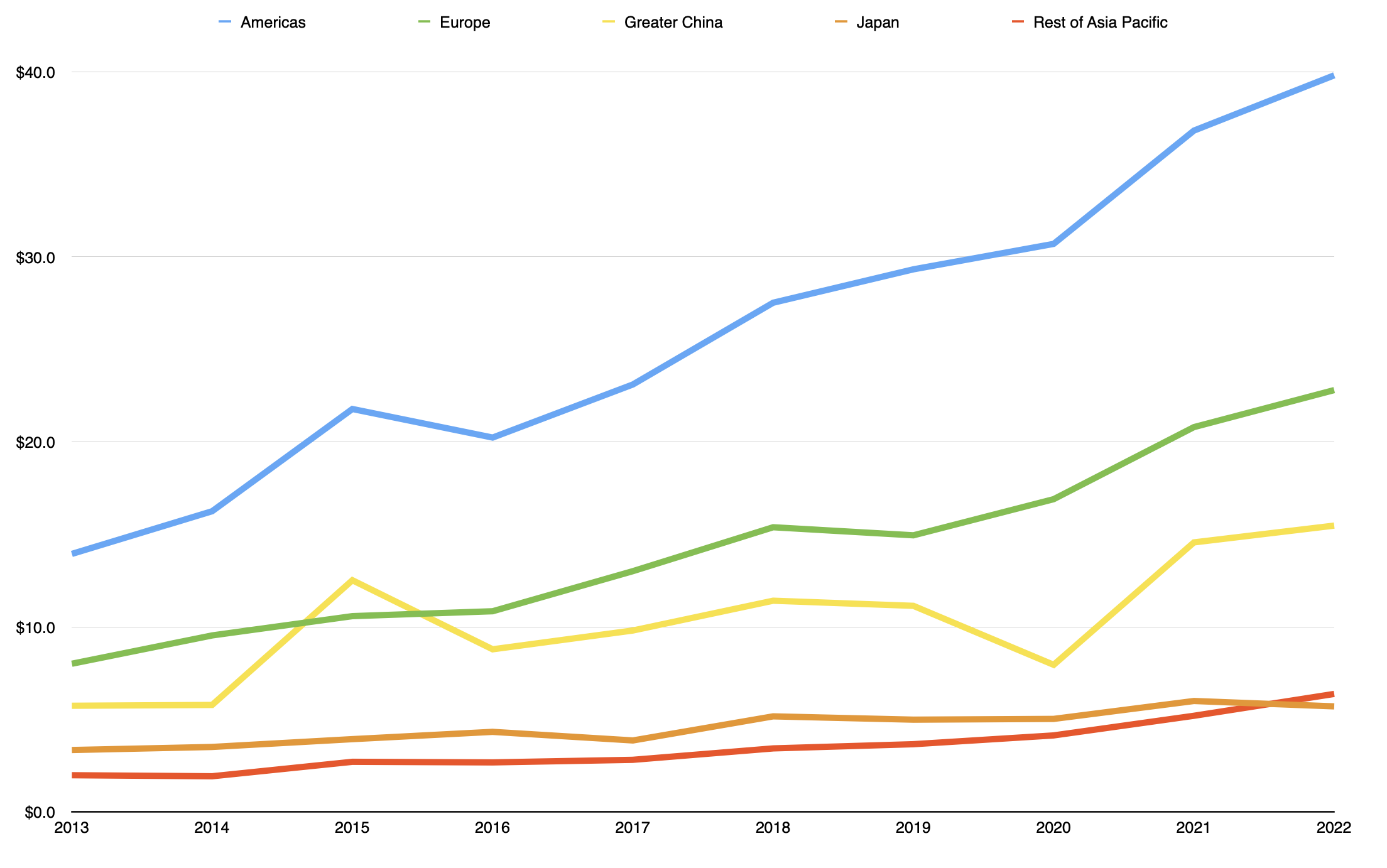

Other interesting numbers appear when looking abroad. While Greater China has been one of Apple’s fastest-growing areas in recent years, revenues there only rose 6.2% year-over-year. Instead, the Asia/Pacific sector saw explosive growth this quarter, with a whopping 22.7% increase. Apple also recorded solid 9.6% growth in Europe and 8.1% growth in the Americas. On the downside, Japan continues to be a trouble spot, with year-over-year revenue declining 4.9% in Q4. Both Cook and Maestri noted that Apple sales in emerging markets were strong, auguring well for the future.

Apple continues to prosper even in today’s chaotic economic times, and this quarter’s numbers prove the value of the company’s focus on product diversity. By having such a wide range of products in its lineup, Apple has offerings for every market. For years, iPhone sales boomed while Mac sales lagged, but now the Mac is starting to become Apple’s fastest-growing category. Contrast Apple’s upbeat results with troubled earnings reports from fellow tech giants Alphabet, Amazon, and Meta (Facebook). In fact, Meta may no longer qualify as a giant after significant drops in advertising revenue caused the company’s stock price to tank. Meta CEO Mark Zuckerberg has famously bet the company’s future on the ill-defined “metaverse” concept, about which Tim Cook has expressed skepticism.

It remains to be seen if the iPad’s slump can be resolved with new models and iPadOS 16 (see “Apple Reimagines the Basic iPad for 2022” and “New iPad Pro Models Gain M2 Processor, Faster Wi-Fi, and Apple Pencil Hover,” 18 October 2022). The all-important holiday season is upon us, and how well Apple does, between significant new product releases late in the year and continuing foreign exchange challenges, will decide whether the company’s days will be merry and bright or festooned with lumps of coal.

Contents

Website design by Blue Heron Web Designs